Frontline banking employees like tellers are large determinants of customer loyalty, customer retention, and the organization’s corporate image. Not only are tellers more visible and have more contact with clients, but they also determine the speed and quality of most bank product deliveries. The teller is the primary conduit between customers and the money they hold at the bank managers, who are often behind the scenes, might not always be aware or appreciative of the important roles these employees play in their organization’s success. As a result, frontline employees are often underpaid, overworked, and undertrained.

As banking evolves and globalizes with fast-changing technology, bank managers should make sure that tellers can cope with these changes and demands, and still fulfill their role of retaining customers.

OKRs can help your institution prioritize your tellers and improve their work by focusing on a specific objective and determining the actions that need to be taken to see the objective through.

Below is a list of metrics followed by suggestions for improving teller operations. These suggestions can be combined with metrics to develop measurable and actionable key results to achieve your objectives for improving frontline employees.

You can measure the effectiveness of teller operations by using the following:

- Deposit Accounts per Teller: This can be calculated by dividing the total number of deposit accounts managed by the bank by the total number of tellers in the service of the bank at the same point in time.

- Transactions per Teller: You can derive this by using the total number of bank tellers working at retail branch locations to divide the total number of transactions processed by bank tellers at retail branch locations over a particular period of time.

- Deposit Processing Error Rate: This can be gotten by dividing the total number of deposits processed that contain errors by the total number of deposits processed over the same period of time as a percentage.

The two main ways you can improve teller operations are by investing in training your bank tellers and by investing in an automated cash recycler.

Benefits of training branch bank teller

- Well-informed Service: Training your bank teller will ensure that he or she is adept in understanding the rules of the bank, protocols, products, and services. He or she will be up to date when it comes to federal rules and regulations, making him or her a more efficient employee.

- Organized delivery: An organized teller will be effective in completing tasks due to quick access to items he or she uses frequently. You don’t have to search for a perfectly organized teller when you can train the ones you have.

- Enhanced Customer Engagement: Training your teller will help him or her with their customer engagement skills. Listening actively to customers and knowing how to respond to their requests will ultimately improve the customer experience.

- Zero-error processing: Accuracy is one of the most important attributes of a good teller. Going back and rechecking numbers can be a huge time waster. Training will cut out deficiencies and help the teller improve their accuracy. Simple but important details like double-checking that the amount on the account screen and the withdrawal slip match will contribute to your branch’s efficiency.

Benefits of purchasing an automated cash recycler

An increasing number of Financial Institutions are recognizing the clear advantages that can be gained from using cash recyclers. By investing in Automated Cash Recyclers, banks provide easy access to withdrawal and deposit services for customers. Banks can save anywhere from 40 to 66 percent on cash-handling costs by upgrading to cash-recycling ATMs.

- Enhanced security: An automated cash recycler guarantees less cash in circulation on the floor. As a result, the risk of losing money reduces drastically as well as liability insurance.

- Fewer transactions: An automated cash recycler ensures that you will no longer need the two-drawer system. Your teller will no longer have to move cash from one drawer to the other throughout the day, which ultimately reduces the risks of having cash in transit.

- Streamlined staffing: You will be able to streamline your staffing needs when you have an automated cash recycler. With the recycler handling more menial tasks, your employees can focus on other tasks like assisting customers.

- Saves Time: By purchasing an automated cash recycler, you’ll be able to cut down on time spent sorting, validating, and counting money. Freeing up this time gives you more time to focus on the in-person interactions that are crucial to your institution’s success. Taking this automated approach reduces costs for the Financial Institution by optimizing the cash in transit cycle.

Cash recycling reduces the need for branch employees to dedicate time to routine tasks such as filling and monitoring ATMs, meaning they have more time to focus on delivering a valuable, personalized and mutually beneficial service to customers

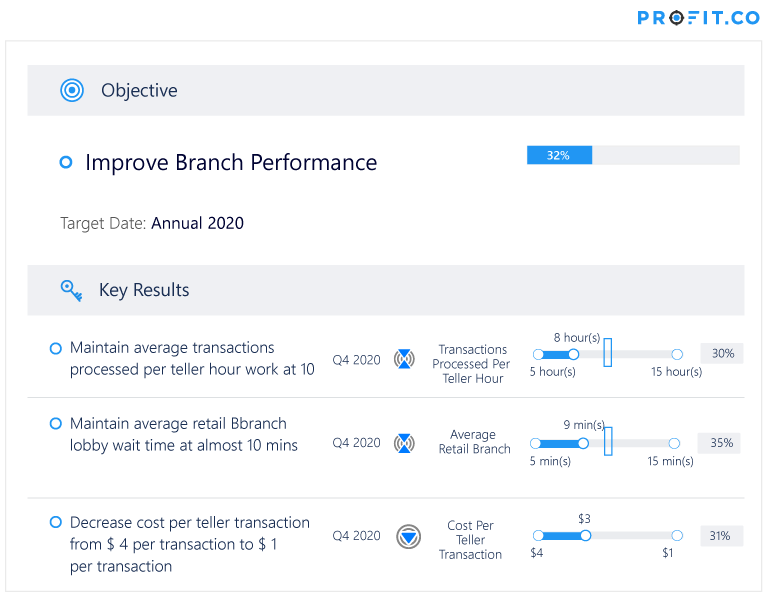

In a nutshell, an automated cash recycler coupled with a well-trained teller is the best way to improve your branch’s efficiency. You can develop an OKR to highlight the importance of improving teller operations in your organization, to focus your attention on that goal. Your objective can be as simple as “Improve Teller Operations” and then you can create key results based on how you’re going to achieve that objective.

By improving your bank’s teller operations, you can ultimately improve both your organization’s customer experience and in turn, improve its profitability and brand. Therefore, your objective to “Improve Teller Operations” could align and contribute to a larger corporate OKR like “Improve Customer Experience”, or “Improve Brand Reputation”, which will ultimately connect to a goal like “Increase Revenue.”

Banks that invest in a comprehensive, integrated approach – where cash recycling is twinned with well-trained tellers will be in the strongest position to achieve tangible gains.

Related Articles

-

Growing Commercial Lending

Growing loans is the primary means by which bank executives improve revenue. However, if a bank’s process is inefficient, commercial... Read more

-

Improving Trade Operations & Support

In banks and other financial institutions, trade operations both facilitate and oversee daily transactions. They’re also responsible for executing trades... Read more

-

Improving Loan Servicing

The administrative process behind collecting interest, principal, and escrow payments can be hectic and counterproductive when it’s not handled properly.... Read more

-

Improving Loan Operations

Loan operations are an integral part of the revenue for a banking system. It’s imperative that organizations dedicate sufficient time... Read more