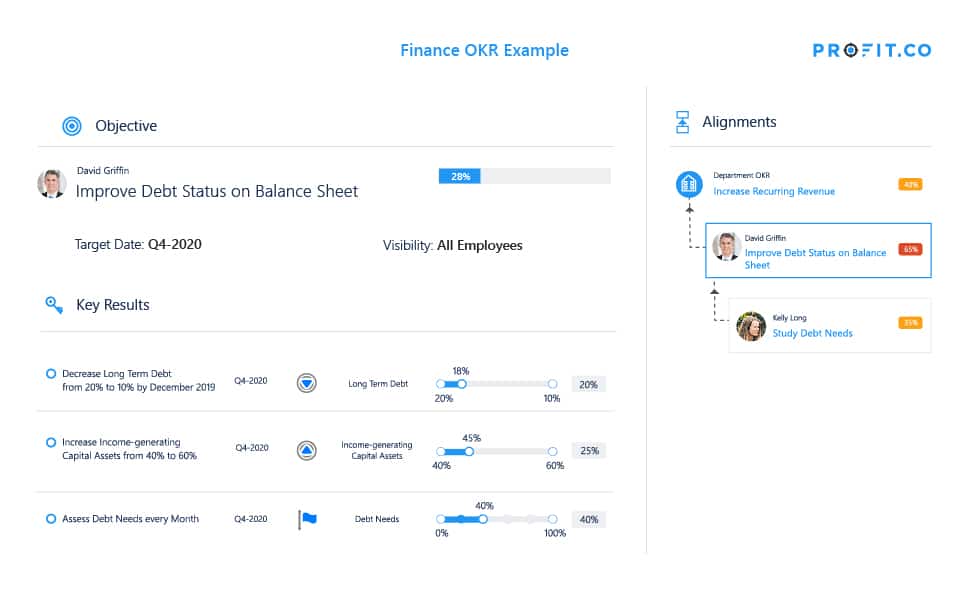

OKRs are a much needed task and performance management tool that guides organizations to set and align goals by ensuring that the various departments and teams of an organization work collaboratively. In order to manage the finance department the finance manager must definitely make sure to maintain a balanced account sheet to produce a well defined account summary. This balanced sheet will progressively help you improve the debt status. The manager can use the following KPIs to measure his or her performance towards maintaining a balance sheet on improving debt status.

1. Long term debt

Long-term debt refers to an amount on the balance sheet which is due in more than 12 months’ time. If your company records $400,000 in long-term debt, decreasing it by 50% would have a positive impact on your balance sheet.

2. Income-generating capital assets

You can utilize income-generating assets to increase revenue. If you are increasing income-generating assets by 20% it would in turn increase overall revenue which will improve your debt status.

3. Debt needs

It’s important to regularly assess debt needs with internal stakeholders. Schedule weekly and monthly team meetings to discuss how to reduce debt, analyze and monitor balance sheet ratios to assess the leverage of long term debt, and prepare and submit a detailed report; this will ultimately set you on a better path to avoiding debt moving forward.

With these units of measurement, finance managers can then develop an OKR to improve their organization’s debt status: Follow the below example