According to a Federal Reserve report from 2018, the top ten card issuers held over 85% of outstanding credit card balances in the U.S. Collectively, American consumers were reportedly juggling $1.08 trillion in debt in 2019. There’s no doubt that the credit card industry is extremely lucrative, but it’s currently dominated by only a handful of companies. Banks and financial institutions should see credit cards as an opportunity for growth and capital.

To truly make the most of what the credit card industry can offer, banks can create OKRs to focus on how they can contribute to their organization’s success. Before writing your OKRs, however, it’s important to consider what your company can be doing to improve.

Financial institutions can measure how well they are doing regarding credit cards by using the following metrics, which can be used as KPIs for key results:

- Transactions per Debit Card: This can be derived by using the number of debit cards the bank managed to divide the total number of processed debit card transactions over the same period of time.

- Voluntary Credit Card Account Attrition: This can be calculated by dividing the total number of active customer credit card accounts closed by the bank due to unpaid balances by the total number of active customer credit card accounts managed by the bank over the same time.

- Debit Cards per Debit Card Support Employee: This can be derived by dividing the total number of ATM/debit cards the bank manages by the total number of ATM/debit cards that support employees the company has at the same point in time.

How to increase Credit Card use

Credit card use has skyrocketed in recent years, with an estimated 41 billion card transactions in 2018 in the U.S. alone. With such a high volume of consumers using cred cards every day, it’s important that banks understand how they can use this to their advantage.

Emphasize on deferred payment

An average credit card owner knows that he or she only has between 30 and 45 days to pay off a credit card purchase without having to pay any additional charge. However, he or she does not have that kind of luxury with a debit card purchase. A debit card purchase must be paid within a day or two. Failure to do so will result in additional charges. According to the Consumer Financial Protection Bureau (CFPB), if your bank emphasizes this advantage, more customers will see reasons they should have credit cards rather than debit cards. You have to be deliberate about reiterating this message through your frontline employees, service representatives, as well as digital platforms.

Employ payment deadline alert

It is expected that credit card users pay their credit card bills on time before the deadline. However, there is no harm in helping them with reminders in order to get them to pay their bills on time. The CFPB reckons that this will ensure that more people using credit cards will be able to be more proactive in working towards paying their bills and avoid missing their payments. If customers frequently fail to pay their credit card bills, they may choose to switch to a debit card. Therefore, financial institutions can be proactive to encourage their customers to stick with their current credit cards.

By combining the focus areas above with metrics, you can develop OKRs to improve your organization’s credit card-based profit.

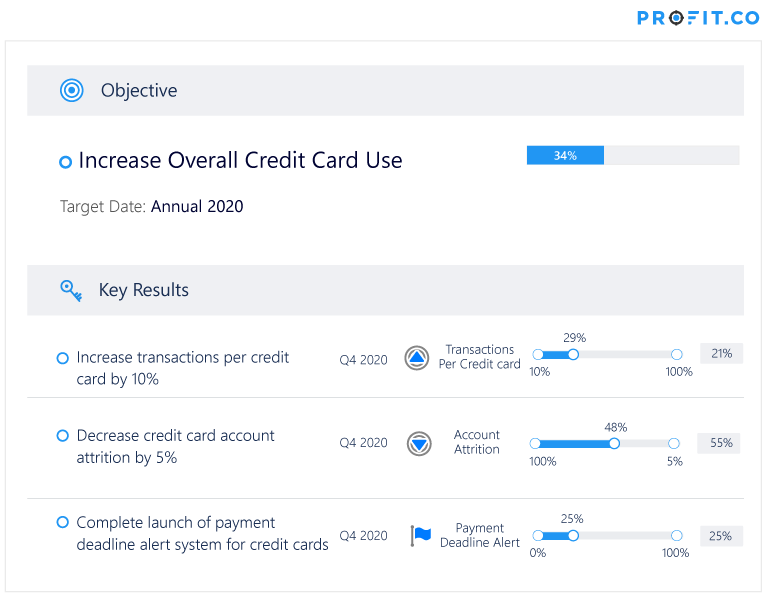

An OKR example pertaining to credit card use would be:

Focusing on how credit cards can increase your revenue will contribute to the organization’s overall profitability. The goal of most institutions always connects back to profitability and based on the statistics surrounding current credit card use, it is certainly a lucrative industry to take advantage of. For that reason, a credit card-based OKR could connect with any corporate OKR pertaining to revenue or monetary success, such as “Improve Profitability” or “Increase Revenue.”