With the advancement of digital technology and the increasing number of channel options, traditional branch locations are struggling. However, brick and mortar branches have long been a foundation of the banking industry and can offer a personalized and efficient experience for customers.

Branches need to do their best to keep up with the evolving environment and support the digital channels and services that are available in today’s market. There are four types of bank branch performance metrics. You can use OKRs to prioritize your branch’s operations and develop a specific objective alongside actionable key results.

Metrics for measuring branch improvement

- Productivity – Examines the effectiveness of a bank branch process, these key performance metrics for banks are usually measured in output in relation to the input.

- Quality – These metrics focus on how efficiently certain processes are being performed.

- Service – These bank branch performance metrics focus mainly on customer satisfaction, bridging customer needs to internal processes.

- Cost – Keeping costs low is integral to any bank branch, making these metrics very important to track, but not at the expense of other metric types.

Below is a list of metrics for improving your branch’s operations.

- Wait Time: The time it takes for customers to wait before getting in contact with a service representative. The faster it takes for your customers to be able to contact a service representative, the better the performance of the branch.

- Assist Time: Assist time evaluates the time it takes to assist customers with their challenges. The faster it takes to assist customers with their complaints, the better the performance of the branch. A longer assist time will also lead to longer wait time.

- Transactions per ATM: You can calculate this by using the total number of ATM machines maintained by the bank to divide the total number of transactions processed at ATMs over the same period of time. An increase shows that you are doing something right.

- New Accounts Opened per Platform Employee: The total number of accounts each employee in this unit opened within a month is a significant metric for measuring the improvement of your branch. A simple way of calculating this is by dividing the total number of new accounts opened by the total number of platform banking employees.

Initiatives for streamlining your branch operations

Install self-directed technology: You can take advantage of self-service options to cut down on wait time. You can leverage technology by installing smart ATMs that will allow customers to handle quite a number of issues without having to navigate long queues.

Automated alerts: You can also take advantage of automated systems to evaluate your wait time. Automated alerts will enable employees to know when wait times are exceeding the standard. It will caution them to work faster while ensuring that they are effective in helping customers resolve various issues.

Use multiple channels: Use different channels to respond to the queries and complaints of customers to reduce wait time and assist time. Options such as self-service online, mobile access, and call center should be maximized to reduce pressure on any particular channel.

Staff training: The importance of training employees cannot be overemphasized. Employees that have direct contact with customers have to be trained to take advantage of interactions to boost sales and revenue. They should also be trained to respond faster to the needs of customers to cut down wait time and assist time.

Integrate tablets into lobby service: You can make things more comfortable and convenient for customers by employing tablets or iPads for customer sign-in. This is a cheap and effective gateway for queue management.

OKRs:

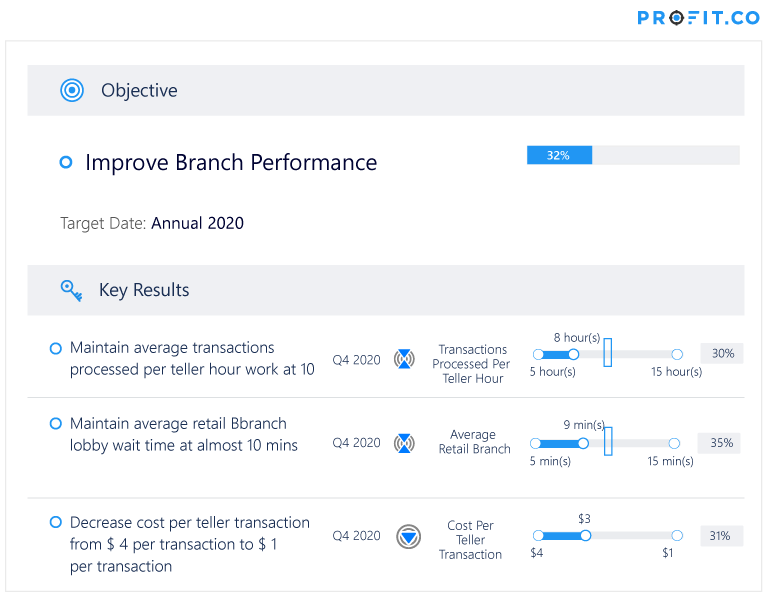

The 4 common metrics that speak about the health of the branch are: Productivity, Combining the suggestions above with metrics or KPIs will help you create an OKR that’s focused on improving your branch’s performance. Your objective can be as simple as “Improve Branch Performance” and then you can create key results to articulate how you’re going to achieve that objective.

The KPI for the first Key Result, KR1, is found by calculating the total number of teller transactions (deposits, withdrawals, money orders, etc.) divided by the number of tellers working. A retail branch wants its tellers to be productive, therefore a high value for this metric is preferred. Low productivity could indicate inefficient transaction processes, lack of training and job aids, or overstaff. To keep this metric high be sure to align tellers hours with high traffic hours and dedicate training time to improve any teller weaknesses.

The KPI for KR2 is calculated as the average amount of time a customer must wait before meeting face-to-face with a non-teller retail branch service representative.KR2 aims at balancing between the two: being overstaffed and making the average wait time very less which in turn affects the cost and on the other hand, being understaffed during peak hour transactions and make the customer wait for long. This metric has to be maintained over the entire time period, maybe a Quarter in this case and so a Control KPI is used. Cost per Teller Transaction measures the total bank teller-related cost of completing transactions in relation to the number of transactions completed by bank tellers at retail branch locations over the same period of time.

The KPI for KR3 is calculated as the ratio of total bank teller related cost incurred through the completion of basic customer account transactions, and the number of transactions completed by bank tellers at retail branch locations over the same period of time. It includes the teller-related expenses incurred through completing teller transactions for all basic account transactions.

Highly manual transactions, filled with errors and prone to rework, can cause costs to inflate. These processes such as manual data entry or document management need to be re-examined to ensure that they aren’t a sinkhole for costs. The way to work around this is to start by measuring the total teller cost divided by the number of transactions completed and then dive deeper into what could be causing the rising costs of each transaction.

A high cost per teller transaction could indicate more than just highly manual processes, it could also point to overstaffing, poor management, or inadequate teller training. A common impulsive reaction is to reduce headcount to lower the cost per transaction, but this can backfire and impact customer satisfaction and employee morale. The long-term solution will be to lower costs by forecasting work volumes based on historical data to appropriately staff the bank and provide training and job aids for all tellers.

By improving your bank’s branch experience, you’ll ultimately contribute to your organization’s overall customer experience and in turn, increase the bank’s profit. The branch-based OKR could then connect or align with larger corporate OKRs like “Improve Customer Experience” or “Increase Revenue.”